The first place to go if you’re claiming tax credits, filing a return or simply checking your tax position is Revenue’s own website.

In a world where tax compliance often feels daunting, Revenue’s MyAccount offers a lifeline. Whether you’re claiming tax credits, filing a return or simply checking your tax position, MyAccount can simplify the process. Here’s how to make the most of this invaluable resource.

Unlike in some other countries, filing a tax return is not a legal requirement for Irish employees. However, if you want to claim additional credits, such as the Rent Tax Credit, it’s important to understand how to use MyAccount effectively.

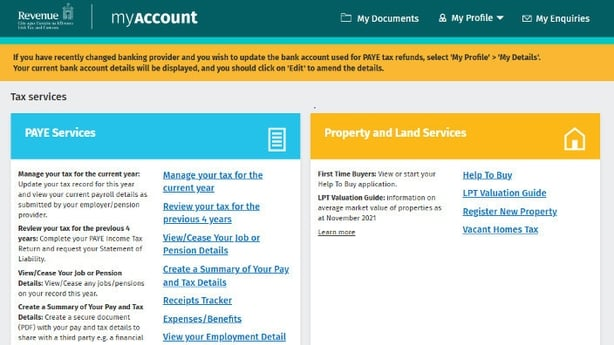

MyAccount is Revenue’s self-service portal designed for individual taxpayers, particularly employees. It allows you to manage your taxes efficiently online without complicated paperwork. From updating personal details to accessing your Employment Detail Summary (formerly P60), MyAccount is a one-stop shop for tax administration.

Where do you start?

Visit Revenue.ie and click on the MyAccount tab at the top right corner to register. You’ll need:

- Your Personal Public Service (PPS) number

- Date of birth

- Phone number

- Email address

Once registered, you’ll receive a temporary password via text or email. Use this to log in for the first time and set your own password. Now you’re ready to explore.

Are you claiming all your tax credits?

Here are some of the most common tax credits available to employees:

Health expenses: You can claim 20% back on unreimbursed medical costs, including GP visits, specialist consultations, prescriptions, and hospital stays.

Physiotherapy: Claim 20% back on eligible expenses for under medical expenses.

Dental treatment: Claim 20% back on non-routine dental treatments such as crowns, root canals, and orthodontics.

Rent Tax Credit: If you are renting, you may be entitled to claim this credit. The amount of the credit is 20% of your rent payments in the year, up to a maximum credit of €750 for 2024.

Gluten-Free Products: If diagnosed by a doctor, a 20% reimbursement on expenses for gluten-free foods can be claimed. Receipts and letter from doctor are required.

Remote Working Relief: If your employer does not make a payment of €3.20 per day, or pays you less than your allowable costs, you can claim Remote Working Relief on electricity and broadband costs. The relief is given at your highest rate of tax.

How do you claim your tax credits?

- On the dashboard, click on “Review Your Tax for the Previous 4 Years”

- Select the tax year you want to review; 4 years is the most you can go back

- Click Request/Amend

- Click complete your income tax return

- Click start

for the first time and set your own password. Now you’re ready to explore.

Personal details

- Ensure personal details are correct

- Ordinary resident Tick “Yes” if you have lived in Ireland for three consecutive tax years or more. Tick “No” if you have not met this condition.

- Irish domicile Tick “Yes”: If Ireland is your permanent home or you have not taken steps to change your domicile to another country.

- Tick “No”: If you have permanently moved to another country, intend to remain there indefinitely, and have severed ties with Ireland.

- Tip: If unsure, check with Revenue or a tax advisor, as these classifications affect your tax liabilities, particularly on foreign income.

Income

- Employment income – press next once it is correct

- Other Income – Fill in this section if you are in receipt of any of these incomes then select next

Add tax credits

Select the specific tax credit you want to claim, such as:

- In health – Medical Expenses: Enter the amount spent on eligible expenses like GP visits, prescriptions, or physiotherapy.

- In You and your family – Rent Tax Credit: Enter details of your tenancy, such as the landlord’s PPS number, rental address, and the total rent paid.

- In Your job: Take a look; flat rate expenses allow a credit or deduction for certain professions.

- Once you have finished adding your tax credits, they will appear below. Confirm all and press the next

Submit your claim

- Review the information you have entered to ensure accuracy.

- Click “Submit” to send your claim to Revenue.

Track your claim

Revenue may contact you for additional information or clarification, so monitor your email or MyAccount notifications.

Supporting documentation

Use the upload feature to attach receipts or documentation required for your claims. Ensure that all documents are clear and legible. Examples include:

- Medical receipts or a statement from your pharmacy.

- A doctor’s letter confirming a diagnosis, if applicable.

- Other qualifying expenses

Can I do this for more than one year?

You can claim tax credits for expenses incurred in any of the previous four years. Don’t miss out on refunds for eligible past expenditures.

Retain all receipts and documents for at least 6 years, as Revenue may audit your claim. It’s rare but possible.

If you have any questions, Revenue’s online chat is a quick way to get clarification. Another option is to use the ‘My Enquiries’ at the top right corner of your MyAccount, where you can write questions and attach letters, but Revenue takes longer to reply to this.