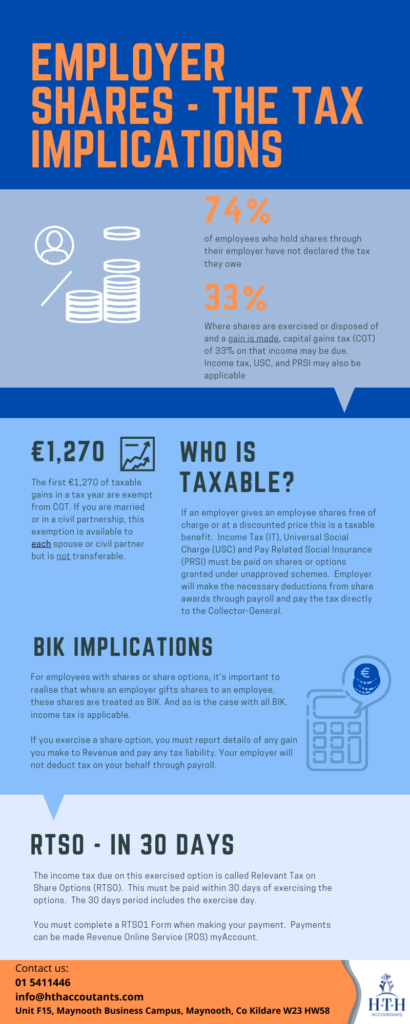

Employer Shares – The Tax Implications

74% of employees who hold shares through their employer have not declared the tax they owe.

Where shares are exercised or disposed of and a gain is made, capital gains tax (CGT) of 33% on that income may be due. Income tax, USC, and PRSI may also be applicable.

The first €1270 of taxable gains in a tax year are exempt from CGT. If you are married or in a civil partnership, this exemption is available to each spouse or civil partner but is not transferable.

Who is Taxable

If an employer gives an employee shares free of charge or at a discounted price this is a taxable benefit. Income Tax (IT), Universal Social Charge (USC) and Pay Related Social Insurance (PRSI) must be paid on shares or options granted under approved schemes. Employers will make the necessary deductions from share awards through payroll and pay the tax directly to the Collector-General.

BIK Implications

For employees with shares or share options, it’s important to realise that where an employer gifts shares to an employee, these shares are treated as BIK (Benefit in Kind). And as is the case with all BIK, income tax is applicable.

RTSO – In 30 Days

The income tax due on this exercised option is called Relevant Tax on Share Options (RTSO). This must be paid within 30 days of exercising the options. The 30 days period includes the exercise day.

You must complete a RTSO1 form when making your payment. Payments can be made via a Revenue Online Service (ROS) myAccount.